2022 Budget Planner Setup

For 2022 I am trying out a new Budget Planner Setup. Last year I have used the Erin Condren Monthly Deluxe Planner as a budget planner but I will be switching to a regular Lifeplanner for next year. You can check out my 2021 Budget Planner Review and 2021 Budget Planner Setup here.

If you are interested in purchasing the same Planner and are new to Erin Condren, you can use my affiliate link to receive $10 off your first order. I will also receive $10 off my next order.

The main differences between the two planners are the additional weekly pages in the Lifeplanner whereas the Deluxe Planner features only monthly pages and lined note pages.

The reason why I switched planners for this year is that I want to track transactions a little more in detail and know how much is in my checking account at all times. I think by tracking my finances this way, I will be more aware of any expenses which will hopefully reduce some unnecessary spending. These impulse purchases can add up! 🙂

By using the weekly pages for budgeting, it is easy to see income, bills, and expenses for that week and I can plan accordingly. Since my husband and I get paid bi-weekly on alternating weeks, we have a paycheck coming in each week. The money coming in gets allocated to fixed expenses first and to necessities such as groceries, gas, etc.. next. Whatever is left gets put into sinking funds.

*** This post contains affiliate links. By purchasing an item through an affiliate link, I earn a small commission at no extra cost to you. ***

Here is a little more detailed explanation about my Erin Condren 2022 Budget Planner Setup

Budget Planner Setup

Yearly Income/ Expense Overview

One of the first pages in the planner is a yearly overview. Here I have marked all of our paydays and other incomes. A few times a year we have an extra payday, so this overview is great for seeing these extra pay months at a glance. I was thinking about adding our bills as well, but I don’t think it would be very useful. All of our bills are monthly bills. If we had bills that are due quarterly or yearly, this page would definitely be good to mark these due dates down as well.

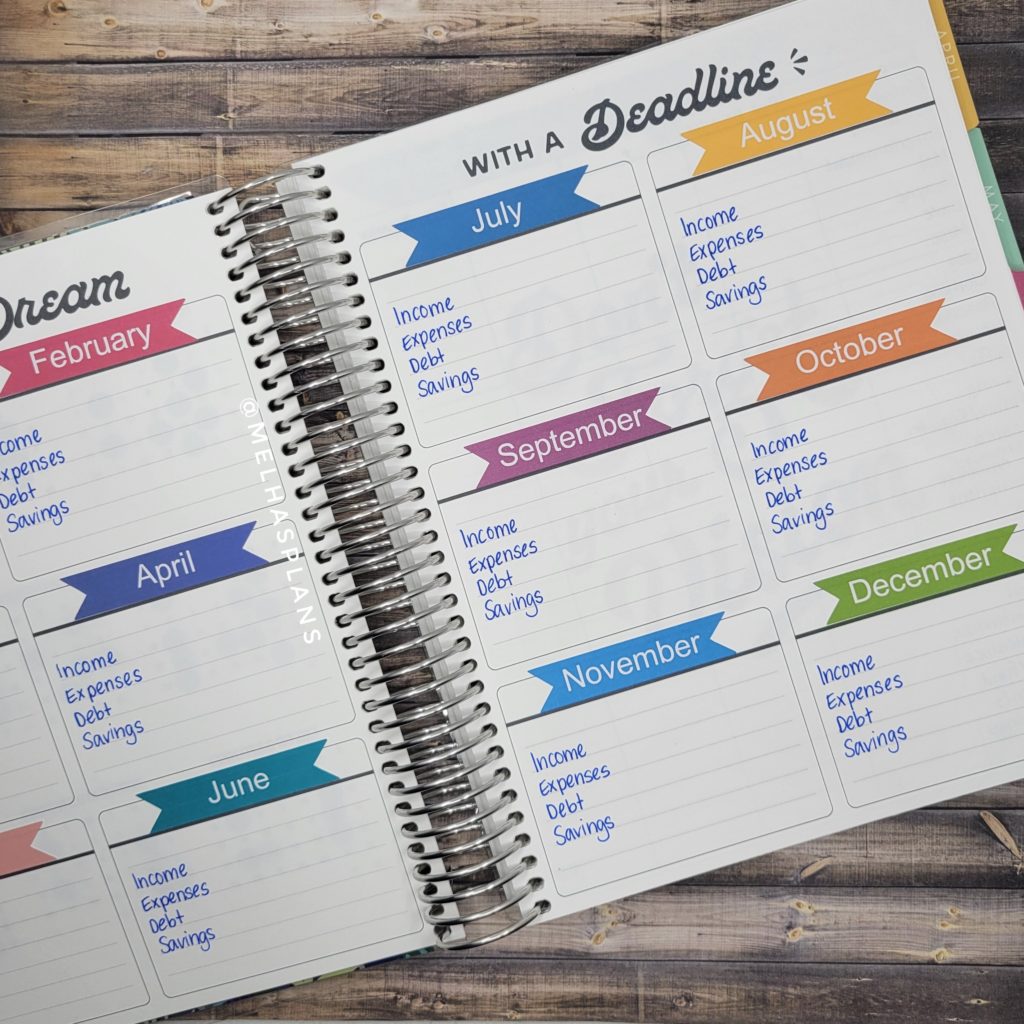

Budget Planner Goal Pages

These pages are great for tracking financial goals, events such as birthdays, weddings, vacations, etc. where extra money is needed, or just simply tracking your debt payoff or savings each month.

I am using these pages as a mini monthly overview that I can compare to other months later. After each month, I write down our income, expenses, debt payment, and savings. Ideally, expenses are reduced and debt payment is increased every month until everything is paid off, after that anything extra will go to savings.

Sinking Fund Tracking

Here is my sinking fund tracker. I have pretty much set up a sinking fund for any expense. I have left out groceries, gas, and pet expenses. These are necessary expenses in my opinion and I will not put a spending limit on them.

Anything like dining out, entertainment, clothing, etc.. is not really that necessary. There are going to be occasions where a household expense or clothing item is necessary to be purchased even though the fund doesn’t have enough money, but that money can always be taken from another fund. Ok, not to make it too complicated…..

The chart below is pretty much self-explanatory. All my sinking funds are listed on the left side. I have them divided into 5 different groups.

- Sinking Funds I – Expenses that occur monthly. They included spending “allowances” for each of our family members.

- Skining Funds II – These expenses are usually not monthly. They occur sometimes or once a year (Subscribtions, Taxes, Licensing Fees). I have also included funds for applicances or electronics.

- Special Funds – Our Emergency Fund, Vet Fund, House and Car Maintenance Fund. Since these will be larger amounts of money, there are kept in a savings account rather than checking account.

- Debt Payments – These are just extra payment we are putting towards debt not the regular scheduled payments.

- Long Term Savings – This is extra money we put into our investment accounts.

The same sinking fund tracker is written down each month. The ending balance from the previous month will become the beginning balance for the new month.

Monthly Calendar Overview

The monthly calendar overview is perfect for writing down all your bills and paychecks. When you receive a bill, you can write down the due date and amount and once a bill has been paid, cross it out or check it off. Use stickers or colorful pens to differentiate bills based on auto-pay or manual pay, debt payments and utilities, etc. Download my Free Printable Bill Tracker Budget Stickers here.

When seeing your paychecks and bills at a glance, you will find it easier to plan ahead and identify any tight spots when a lot of bills are due around the same time.

Monthly Dashboard

The monthly dashboard in this planner is kept pretty blank. There are 4 separate areas that can be customized to your needs. I have set them up this way:

- Bills – All bills due that month are listed in order of due date. I will draw a box beside each one that I can check off once the bill has been paid.

- Goals – Monthly financial goals.

- Notes – Any reminders or remarks regarding our finances.

- Spending Log – Mini Calendar where I will track our spending by coloring in each day with a color according to the key beside it. Green means I didn’t spend more than $50 that day. Red means I spend more than $350 that day.

How I set up the weekly budget pages

These weekly pages are the main part of the planner. It has a sidebar on the left side and 3 boxes for each day of the week. I haven’t started using the planner yet so all these boxes are unfortunately still empty but I will post an updated picture soon once I start using this planner end of December.

The sidebar is for tracking my necessary expenses. As mentioned previously, they are not included in the sinking funds but I do however try to estimate a certain amount for these expenses every month. For example, if I am estimating monthly grocery spending at about $1,000, I will write down $1,000 as the beginning balance in the grocery category. That week I spent $250 on groceries, leaving me with an ending balance of $750. Next week, that $750 will be my new beginning balance.

Each day, I will write down the beginning balance from our checking account at the top of the first box. Any income or expense is tracked in the box below. At the end of the day, everything is added up and I will write down the ending balance in our checking account. Our bank account is pretty much reconciled every day.

The second box is used for credit card transactions and payments. Any purchases made via credit will be reimbursed from the checking account at the end of the week.

The third box is for account transfers and payments made to any savings/ investment accounts.

To take it a step further with logging the transactions, you can use colorful pens to categorize each transaction. Here is the color-coding that I will be using:

- Red – Bills

- Orange – Groceries

- Yellow – Gas

- Green – Income

- Blue – Miscellaneous

- Purple – Savings

- Brown – Debt

- Gray – Transfer

Budget Planner Note Pages

The regular Lifeplanner has about 10 lined note pages in the back of the planner. Since I am already tracking so much in my previous pages, the number of note pages in this planner is enough for me. The Monthly Deluxe planner has a ton of note pages with the option to add extra but I have found that I wasn’t using most of them. Here are a couple of trackers that I have set up already but I will probably add a few more things

Debt Payoff Tracker

If you are trying to pay off a credit card or loan, a debt tracker can help you with that. This chart that I drew is simple but helpful to make sure the purchases and any interest charges that might occur are covered by the credit card payment that you make. I have also a free printable debt pay-off tracker available in my printables section. You can just print it out on paper and glue it on one of the pages.

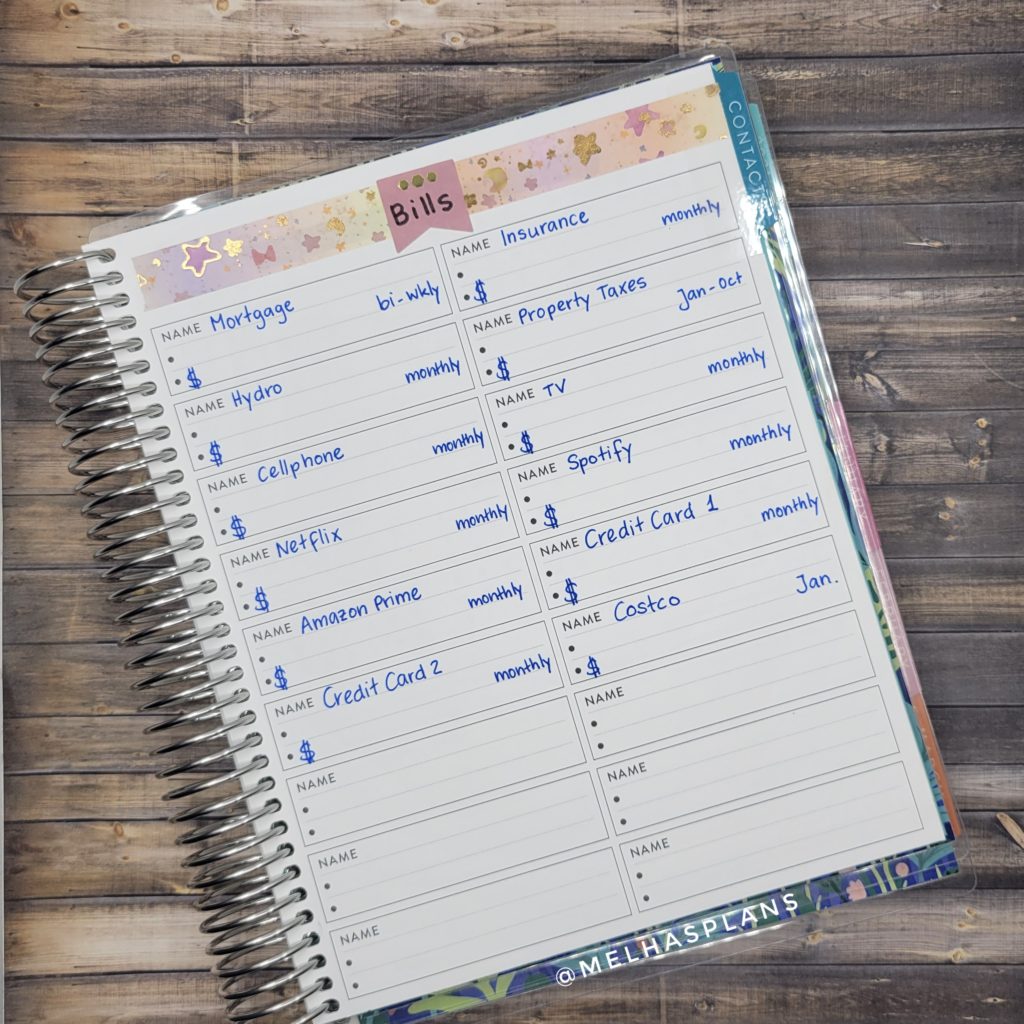

Bill Overview

This planner has an address page that I will not be using. Instead, I listed all our bills, due dates, amounts, and frequency. Another great idea for this page is to write down all your bank accounts that you have.

Budget Planner Stickers

To make budget planning easier, I have created a few budgeting stickers. These stickers are available in my online shop Mel Has Plans . More stickers will be added frequently. Thanks so much looking.

Additional Ideas for Budgeting

I am still setting up this planner. These are my initial ideas but there are a few blank spaces left. I will update this post when I have a few more things added. Please let me know in the comments below if you have any questions or suggestions.

Thanks for reading. I hope you liked this post. Please follow my Instagram @melhasplans or subscribe to my monthly newsletter below to

This is a great idea. Seems to have room for every thing one would need. I admit we do not do much for budgeting. I have a limited spreadsheet that I set up and don’t use. This would be very helpful.